In 2023, the DEX sector, as the core infrastructure of blockchain, was quite languishing. In the face of the narrative of the omni-chain, leading DEXs were busy with involutional performance iterations, with few breakthrough innovations in new paradigms. BeingDex is an innovative omni-chain order matching trading platform, featuring peer-to-peer wallet matching, order book placement, and omni-chain trading, to truly achieve the convenience and high performance comparable to centralized exchanges.

– BeingDex is not only a technological innovation, but also a model innovation, representing a new direction for the development of DEX from single-chain to omni-chain.

– While the leading DEXs are still consolidating their positions by focusing on improving efficiency, BeingDex, refusing to survive in the cracks of the leading apps, is taking a brand-new move to realize the breakthrough of the DeFi and launching itself towards the ultimate goal of the underlying DeFi infrastructure.

– BeingDex is not only a trading application, but also a one-stop omni-chain asset management service platform, which foresaw the potential needs of the future crypto community and users in its design.

Looking at the development of the decentralized exchange (DEX) sector in 2023, the leading DEXs are competing around two main themes: improving capital efficiency and multi-chain deployment. They have successively launched more complex liquidity strategies in order to increase total value locked (TVL), strengthen their moats, and defend against attacks from other DEXs and centralized exchanges (CEXs) competitors. However, the increasingly complex liquidity management strategies not only please liquidity providers but also significantly increase the application threshold of DEX, which obviously contradicts the industry vision of Web3 mass adoption. Meanwhile, in the face of the new paradigm of omni-chain transactions, leading DEXs still cannot provide the convenience beyond traditional CEX, and merely relies on integrating a large number of third-party cross-chain bridges and optimizing aggregators to maintain the existing defensive position.

In early 2024, against the backdrop of intense competition in the head DEX space, BeingDex emerged with a series of groundbreaking innovations. As a native DEX of Mango Network which is a transactional omni-chain L1, BeingDex positions itself as an omni-chain trading platform, providing unprecedented trading experience for both on-chain and cross-chain transaction users with the modular and high-performance features of the Move language.

User experience comparable to CEX

The inherent advantage of DEX is the wide range of permissionless and widely supported long-tail token assets. However, CEX still attracts cryptocurrency traders with its exclusive order book interface, real-time candlestick charts, low slippage, and high trading depth. BeingDex combines the advantages of both CEX and DEX, providing users with limit orders, visualized and highly transparent trading interface, helping users make accurate decisions and obtain the best trading prices.

Unlike traditional DEXs, the trading interface of BeingDex clearly displays the price trend of assets in the form of candlestick charts. Users can place limit or market orders through the order book, with limit orders effectively avoiding trading slippage and also mitigating the common MEV attacks in DEXs, ensuring maximum user security. In addition, the order book can visually display trading depth, providing higher market transparency and being more user-friendly for leveraged trading and stop-loss trading.

Providing the best solution for omni-chain transactions

In the era of omni-chain transactions, DEX is no longer limited to deployment on a single public chain. As of January 2024, the leading DEXs have all achieved multi-chain deployment, with SushiSwap and Curve deployed on 28 and 13 blockchains respectively. Multi-chain deployment can effectively reduce user gas consumption, but it also fragments the liquidity pool of single-coin assets. Users still need to prepare different tokens as gas for operations on different chains, which increases the complexity of user operations.

BeingDex’s omni-chain transaction design concept provides users with the most convenient and unified trading experience. As a DEX supporting omni-chain transactions, BeingDex makes it possible for users to prepare only one token as Gas, and through wallet-to-wallet aggregation transactions, they can complete the omni-chain transaction process of mainstream tokens on more than 50 L1/L2 blockchains, which dramatically downgrades the complexity of the transaction operation.

For example, users can use MGO tokens as Gas to complete BTC and ETH exchanges on BeingDex deployed on the Mango Network mainnet; they can also use BNB as Gas to achieve BNB and ETH exchanges via modular contract deployed on BNB chain. Based on the combination of Mango’s main chain contract and modular contract, BeingDex can provide a more diverse range of token trading pairs than CEX, enabling omni-chain transactions of mainstream tokens and long-tail assets.

Based on Mango’s native cross-chain bridge, BeingDex does not need to integrate a third-party cross-chain bridge, which helps users to significantly reduce cross-chain costs. The limit order mode based on the order book helps users to realize zero slippage, and there is no need to rely on the aggregator and differential algorithmic models commonly used in other DEXs, which significantly reduces the complexity of the BeingDex smart contract and thus significantly improves the security.

Competing for DeFi underlying infrastructure

The competition on the DEX track has always been fierce, and the release of Uniswap’s V4 represents a future direction, namely a shift from transactional applications to a cryptographic trading infrastructure platform that supports user customization, allowing developers to develop more use cases based on their own needs and community needs. However, Uniswap V4 cannot fundamentally solve the liquidity fragmentation problem caused by multi-chain deployment. Only native omni-chain DeFi applications are truly eligible to participate in the competition for the underlying infrastructure of DeFi in 2024.

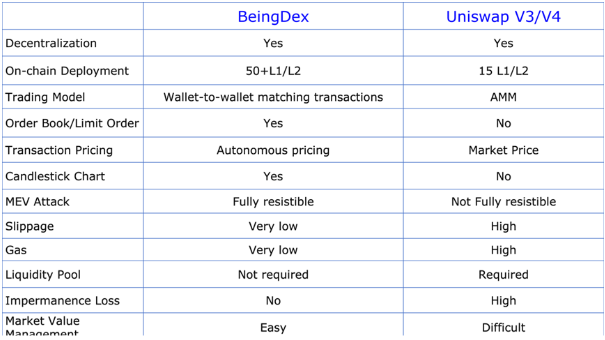

Relying on the natural advantages of Mango Move language in terms of modularity, high performance and security, BeingDex can achieve parallel processing of over 100,000 TPS and sub-second transaction confirmation, and completely resist MEV attacks that bring huge slippage losses to users. In addition, BeingDex can achieve omni-chain applications via single-chain deployment, and support unified liquidity pools and user pools, and with ultra-low gas costs. BeingDex has fully implemented the advantages brought by the iterative innovation from Uniswap V1 to V4 in the original design stage. Based on the advantage of the Move language, BeingDex effortlessly achieves technological superiority over traditional leaders in the DEX field.

BeingDex is not just a trading application, it is designed with a forward-looking anticipation of the potential needs of the future crypto community and users. It continuously expands the service boundaries of DeFi and independently develops key Web3 infrastructure such as Being Crypto Wallet, yield farming pool, POS staking pool, IDO/IEO, NFT trading platform, decentralized social applications, and DAO, providing users with a one-stop omni-chain asset management service.

8 major innovations empower the crypto communities

Compared to traditional DEX, BeingDex has achieved innovations in the following aspects, providing unique value to the community and users:

- omni-chain transaction – based on the advantages of Move language and modularity, supporting over 50 L1/L2 public chains.

- Order book pending order – supports limit orders and market orders, no trading slippage, trading records can be verified on-chain.

- Decentralized candlestick chart – clear and intuitive price trend chart to assist in making wise trading decisions.

- Wallet peer-to-peer matching trading – support multiple multi-chain wallets for peer-to-peer matching trading.

- No liquidity pool – avoid impermanent loss, user assets are self-custodied, ensuring asset security.

- Fully resist MEV attacks – combining Move language features with order book mode, completely avoid MEV attacks and frontrunning.

- Support market value management by market makers – very friendly to market makers, empowering the crypto community, and achieving easy market value management.

- Wallet Security – Adopting two major security mechanisms of user asset self-custody and complete anonymity, the underlying wallet technology supports multiple security protections such as local biometric encryption and secure isolation.

Traditional DEXs face issues such as fragmented liquidity, high transaction costs, and poor user experience, which hinder the further development of DEXs. While traditional DEX platforms are still focused on improving efficiency to solidify their position, the emergence of BeingDex represents a new offensive approach to disrupt the DeFi sector and make a breakthrough towards the ultimate goal of DeFi infrastructure.

The developer behind BeingDex

As a native DeFi application of Mango Network, BeingDex has received support from thousands of developers in the Move community throughout the entire process from conception to development. Aryan Nava, a Canadian-Indian developer, is the “key man” driving the continuous growth of the project.

Aryan, who settled in Toronto, was involved the IT industry as a system administrator in 2000. With his talent and self-study, he became a system engineer at the 7th largest stock exchange in the world, the Toronto Stock Exchange, and then focused on the fields of blockchain and network security. During his 6 years at the Toronto Stock Exchange, Aryan experienced the allure of trading and the comprehensive customer experience provided by centralized exchanges. He is determined to create a new generation DEX that can realize the vision of decentralization and provide a perfect customer experience comparable to centralized exchanges.

Aryan recalls that he met with Vitalik Buterin three times in Toronto and Vancouver starting in 2014, discussing the feasible path towards decentralized securities trading. Speaking of this experience, Aryan said, “unfortunately, due to work commitments, I was unable to accept the invitation to participate in Ethereum development. But BeingDex is where my true interest lies, which will create a new paradigm for omni-chain DeFi applications, and the support from the Mango Network community has already shown me the dawn of success.”

Conclusion

The emergence of BeingDex is not only a technological innovation, but also a model innovation, which represents a new direction for the development of DEX, that is, from a single chain to omni- chain. It can break the liquidity and user fragmentation caused by heterogeneous blockchains, and realize the free circulation of assets across various blockchains.

BeingDex, as a pioneer in the era of omni-chain transaction, has great potential for development. The era of omni-chain has arrived, and BeingDex is expected to become a breaker and lead a new round of innovation in the DEX field.

About BeingDex

BeingDex, an innovative Omni-chain order matching trading platform

BeingDex is a decentralized exchange developed based on Mango Move, supporting on-chain order matching, with prominent innovations, such as wallet-to-wallet matching, order book mode, support for candlestick charts, and no need for liquidity pools.

BeingDex supports a wide variety of on-chain assets, including tokens, NFTs, and inscriptions, and can bring on-chain liquidity into various Web3 applications as a liquidity gateway.

The BeingDex team is constantly expanding the boundaries of services, providing users with one-stop asset management services through Crypto Wallet, DeFi, yield farming, POS staking pool, IDO, NFT trading platform, decentralized social applications, and DAO, among other Web3 key infrastructure.

- Website: beingdex.com

- Twitter: https://twitter.com/BeingDexOS

- Medium: https://medium.com/@BeingDex

- Youtube: https://www.youtube.com/@BeingDex

- Github: https://github.com/BeingDexOs/beingDex

• Telegram:https://t.me/Beingdexweb3

I’m a highly experienced and well-respected author in the field of Cryptocurrency. I have been writing on the subject for over 5 years which has made me one of the leading experts in the field. My work has been featured in major publications such as The Wall Street Journal, Forbes, and Business Insider. I’m a regular contributor to CoinDesk, one of the world’s leading cryptocurrency news websites.