Introduction

Social impact investing and sustainable finance have been gaining popularity in recent years as investors seek to make a positive impact on society while also generating financial returns. Cryptocurrency, with its potential to decentralize finance and enable borderless transactions, has the potential to play a significant role in social impact investing and sustainable finance. In this article, we’ll explore the different ways that cryptocurrency is being used in these areas.

Cryptocurrency and Sustainable Finance

Sustainable finance aims to promote economic growth while also taking into account environmental, social, and governance (ESG) factors. Cryptocurrency can help achieve these goals by enabling more efficient and transparent financial transactions that are not tied to traditional financial institutions.

One example of how cryptocurrency is being used in sustainable finance is through the creation of green cryptocurrencies. These are cryptocurrencies that are specifically designed to support sustainable projects and initiatives. For example, the SolarCoin cryptocurrency rewards solar energy producers with tokens that can be exchanged for other currencies or used to pay for goods and services.

Cryptocurrency and Social Impact Investing

Social impact investing focuses on investing in projects and businesses that have a positive impact on society. Cryptocurrency can help support social impact investing by enabling direct investment in projects and businesses without the need for intermediaries.

One example of how cryptocurrency is being used in social impact investing is through the creation of social impact tokens. These tokens represent a share in a social impact project or business and can be bought and sold like traditional securities. This enables investors to directly support social impact projects and earn financial returns at the same time.

Another way that cryptocurrency is being used in social impact investing is through the creation of microfinance platforms. These platforms enable individuals to lend or borrow small amounts of cryptocurrency to support social impact projects and businesses. This can help support economic development in underprivileged areas and promote financial inclusion.

Challenges and Opportunities

While cryptocurrency has the potential to revolutionize social impact investing and sustainable finance, there are also challenges that need to be addressed. One of the biggest challenges is regulatory uncertainty. Cryptocurrency is still a relatively new technology, and regulatory frameworks are still being developed. This can make it difficult for investors and projects to navigate the legal landscape.

Another challenge is the volatility of cryptocurrency prices. While this can provide opportunities for investors, it also creates risks and uncertainty for projects and businesses that rely on stable funding.

Despite these challenges, there are also significant opportunities for cryptocurrency in social impact investing and sustainable finance. Cryptocurrency has the potential to enable more transparent and efficient transactions, increase access to capital for social impact projects and businesses, and support economic development in underprivileged areas.

Cryptocurrency and Environmental Impact

While there are green cryptocurrencies that aim to support sustainable projects and initiatives, there are also concerns about the environmental impact of cryptocurrency mining. Cryptocurrency mining requires significant amounts of electricity, which can have a negative impact on the environment. Some cryptocurrencies, such as Bitcoin, have been criticized for their high energy consumption.

However, there are also efforts underway to address these concerns. Some cryptocurrencies are exploring more energy-efficient mining methods, such as proof-of-stake rather than proof-of-work. Additionally, some renewable energy companies are exploring the use of excess renewable energy to power cryptocurrency mining.

Cryptocurrency and Financial Inclusion

One of the key benefits of cryptocurrency is its potential to increase financial inclusion. Cryptocurrency can enable individuals without access to traditional financial services to participate in the global financial system. This is particularly important in developing countries where a large portion of the population is unbanked.

Cryptocurrency can enable individuals to store and transfer value without the need for a traditional bank account. This can also enable individuals to participate in economic activities such as online marketplaces or freelance work, which may be difficult without access to traditional financial services.

However, there are also challenges to achieving financial inclusion through cryptocurrency. One of the biggest challenges is the lack of digital literacy in some communities. Additionally, some cryptocurrency platforms may not be accessible to individuals without internet access or digital devices.

Celebrity Endorsements and Social Responsibility

While celebrity endorsements can increase awareness and adoption of cryptocurrency, there are also concerns about the social responsibility of these endorsements. Some celebrities have been criticized for promoting cryptocurrency without fully understanding the risks and complexities involved.

Additionally, there have been instances of celebrities promoting fraudulent or questionable cryptocurrency projects, leading to significant financial losses for their followers.

It’s important for celebrities and influencers to consider the social responsibility of their endorsements and promote cryptocurrency in a responsible and transparent manner.

Cryptocurrency and Social Impact Investing

Cryptocurrency has the potential to support social impact investing by enabling direct investment in sustainable and impact-driven projects. This can help democratize investment opportunities and provide alternative sources of funding for social impact projects and businesses.

Cryptocurrency can also enable the creation of impact-driven decentralized applications (dApps) and smart contracts that can facilitate social impact initiatives such as microfinance, crowdfunding, and impact measurement and reporting.

One example of cryptocurrency-enabled social impact investing is the emergence of impact-driven cryptocurrencies that aim to support sustainable development goals. For instance, the SolarCoin project rewards solar energy producers with SolarCoins, which can be traded on cryptocurrency exchanges or used to purchase solar energy equipment.

Cryptocurrency and Sustainable Finance

Cryptocurrency can also support sustainable finance by enabling the creation of sustainable investment products and services. For instance, cryptocurrency-based carbon credits can be used to incentivize companies to reduce their carbon emissions, while cryptocurrency-based green bonds can be used to finance renewable energy projects.

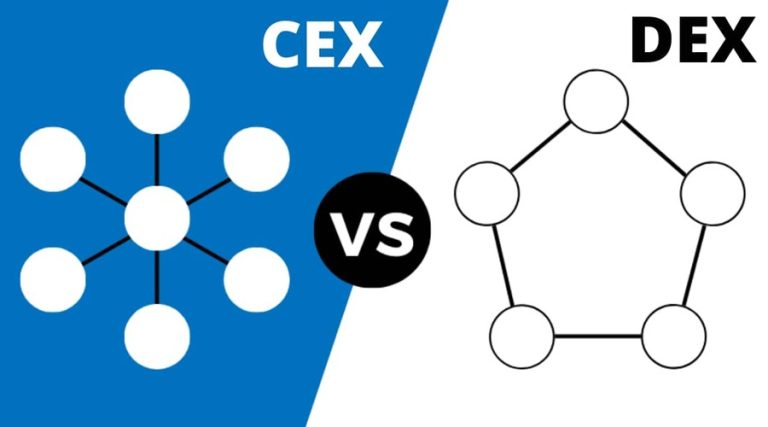

Additionally, cryptocurrency can enable the creation of decentralized finance (DeFi) platforms that can support sustainable finance initiatives such as microfinance, peer-to-peer lending, and impact investing. DeFi platforms can provide alternative sources of funding for sustainable and impact-driven projects and businesses, while also promoting financial inclusion.

Challenges to Cryptocurrency and Social Impact

While cryptocurrency has the potential to support social impact investing and sustainable finance, there are also challenges to the adoption of the technology in these areas.

One of the biggest challenges is the lack of regulatory clarity and oversight in the cryptocurrency space. This can make it difficult for investors and businesses to navigate the complex legal landscape and ensure compliance with relevant regulations.

Additionally, the volatility of cryptocurrency prices can make it difficult to create stable investment products and services. This can make it difficult for investors to manage risk and can create uncertainty for businesses seeking to raise capital through cryptocurrency.

Conclusion

Cryptocurrency has the potential to support social impact investing and sustainable finance by enabling direct investment in impact-driven projects and the creation of sustainable investment products and services.

However, challenges related to regulatory clarity, volatility, and digital literacy must be addressed in order to fully realize the potential of cryptocurrency in these areas. By promoting responsible and sustainable use of cryptocurrency and addressing these challenges, we can work towards creating a more equitable and sustainable global financial system.

I’m a highly experienced and well-respected author in the field of Cryptocurrency. I have been writing on the subject for over 5 years which has made me one of the leading experts in the field. My work has been featured in major publications such as The Wall Street Journal, Forbes, and Business Insider. I’m a regular contributor to CoinDesk, one of the world’s leading cryptocurrency news websites.